After a Medicaid recipient dies, the state has the right to recover any assets remaining in their estate in order to reimburse itself for the Medicaid benefits that were paid out on their behalf. This is known as Estate Recovery.

The estate recovery program applies to anyone who has received Medicaid benefits for long term care. Arkansas are taking advantage of the Federal law that allows the states to recover most assets in which the Medicaid recipient had an ownership interest at the time of their death. Including their Home!!

It is important to note that the state is not permitted to collect any funds they are due as long as there is a surviving spouse. The state may only initiate the claim after both spouses have passed away.

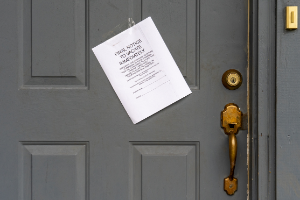

One of the main ways that the states try to use the estate recovery program to obtain reimbursement is to go after the home of the Medicaid recipient. This process can include putting a lien on the property prior to the death of the recipient. However, this is prohibited if the home is furnishing shelter to a spouse, a minor child, or a disabled child.

Historically, the state has only pursued recovery against assets that were titled solely in the name of the Medicaid recipient and needed to be probated. In order to avoid probate, it is recommended that all assets have a specific beneficiary listed. Simply having a will is not sufficient to avoid probate. However, as budgets have gotten tighter, they are being much more aggressive in what they will go after. It is also possible to protect assets from estate recovery if the recipient has a minor or disabled child. Any assets owned by a Medicaid recipient may be transferred to these children at any time with no impact to their eligibility.

0 Comments